Claiming Tax Credits for Your HVAC Upgrades

Home improvements that improve your structure’s energy efficiency may be eligible for federal tax credits. These include equipment for solar, wind, geothermal and fuel cell technology. ENERGY STAR® products are eligible for credit as well because they can reduce energy usage by up to 30%.

It’s best to consult with a tax expert regarding the amount of credit you’re eligible for, as it changes every year. In this post, your local HVAC and plumbing repair expert, R.A. Biel Plumbing and Heating, discusses things you need to know about claiming tax credits for your HVAC upgrades.

Energy-Efficient Home Upgrades

If you’re thinking of getting a new HVAC unit, it may be helpful to know that the tax credit you can get from energy-efficient home improvements is 30% of their cost, including installation. Examples of qualified equipment include solar water heaters, wind turbines and solar-powered appliances. There’s no dollar credit limit for most properties, and if the credit amount exceeds the tax owed, the unused portion can be credited to the following year.

Existing houses and homes under construction are both eligible, and the property doesn’t have to be the taxpayer’s main residence unless the equipment is a qualified fuel cell property. A qualified fuel cell property is an integrated system that converts fuel into electricity by electrochemical means.

Non-Business Energy Property Credit

The first half of the non-business energy property credit covers 10% of eligible equipment or upgrades added to the taxpayer’s main residence the previous year. This covers energy-efficient windows, doors, roofs and insulation, but does not include the installation cost.

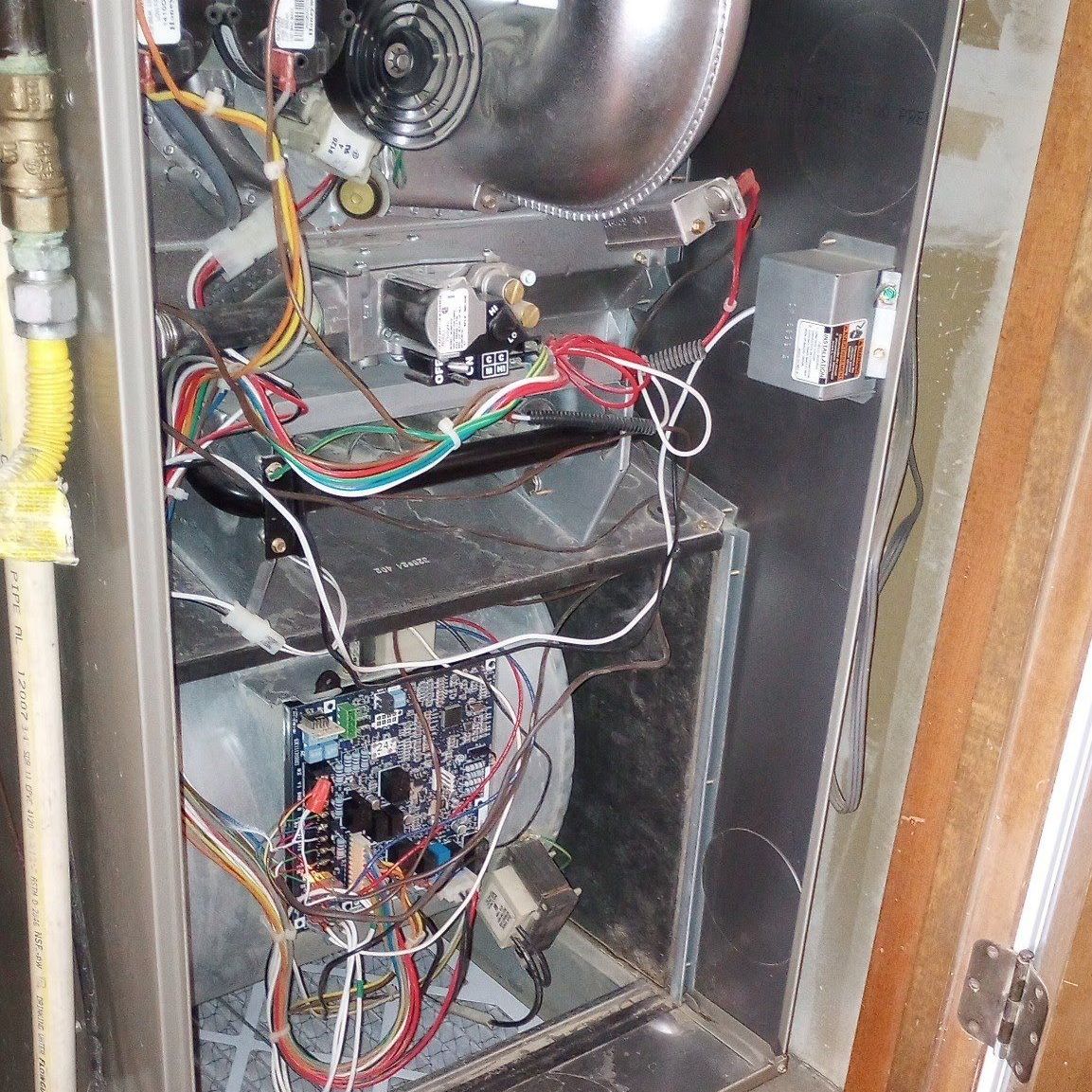

Moreover, the second part of the credit covers the installation costs of certain high-efficiency new air conditioning units, water heaters and biomass fuel stoves. The dollar limit varies for different types of property.

As per the Internal Revenue Service (IRS), the credit has a maximum credit limit of $500. The main residence of the taxpayer should be located in the US, and this type of credit is only applicable for existing homes.

Talk to a CPA regarding your claimable tax credits and find a reliable HVAC contractor that can perform energy-efficient home upgrades. Choose R.A. Biel Plumbing and Heating for your new heating system installation. We also provide quality plumbing and air conditioning services. Call us at (505) 672-7888 or (970) 884-3358. You can also complete our online form.

The post Claiming Tax Credits for Your HVAC Upgrades appeared first on R.A. Biel Plumbing & Heating, Inc..

Our Recent Articles